Credit Card Debt Help

Free yourself from debt with ChapterTwo. Our experienced team can get you back on track today.

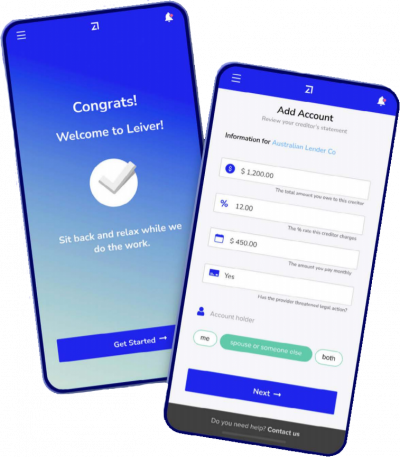

A first in Australia, ChapterTwo has developed an app for you to manage your debts all in one place. More content explaining needed here.

Download our app & watch your balance decrease without interest compounding

This app is the first of its kind in Australia. See your debts in one place without having to login to numerous internet banking sites!

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.

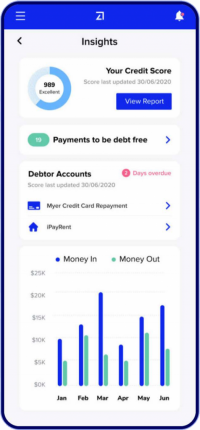

Just one regular payment!

View your live credit score

Stop the calls

We protect your credit rating

No Debt Agreements

Freeze interest & repayments

Reduce debts by up to 80%

Full Support

The ChapterTwo Process

We freeze your interest and work with your creditors

to place you into one of the ‘bankruptcy free’ plans below:

You make one regular payment

Transparency like never before

Utilise our Knowledge Centre

Take control of your debt today

Get in touch for a free consultation. We are fully aware of just how much courage it

takes to ask for help. We listen, we understand, we care and we do not judge.

[FORM HERE]

[REVIEWS HERE]

Recent Case Studies

The Artist

Case Study 1

Debt – $28,000 in credit cards

Solution – Full and final settlement

Overview

Our 60-year-old client was experiencing financial hardship, due to significant decline in commissions for his art work. His financial situation had been deteriorating for a few years, however it wasn’t obvious to our client, as the rollercoaster ride he had been on had become a normal part of his life.

So he ploughed on as usual making artworks and using credit cards to cover his expenses, hoping things would get better, because they had done so in the past. Unfortunately, the latter year turned out to be a very tough one. Virtually no rewards for all his efforts – just more expenses.

Furthermore, there were no suitable employment prospects in the region our client lived in. Feeling despondent and hopeless at not being able to meet is living needs, plus meet his debt obligations, our client turned to ChapterTwo for help.

How we helped:

The Pregnant Pause

Case Study 2

Debt – $90,000 in Credit Card & Personal Loans

Solution – Long Term Arrangement

Overview

Our client started experiencing financial hardship when his wife fell pregnant with their first child and faced complications during the whole pregnancy and after the birth of their child. This warranted ongoing medical attention and she wasn’t able to work.

Our client wanting to do whatever it takes applied for credit cards and personal loans to get by and fell into the trap of using his credit facilities to cover medical costs and the shortfall in income due to his wife not working.

Soon his financial situation spiralled out of control and our client was unable not meet his debt repayment obligations. This significantly impacted our clients mental state, as being the sole provider for the family this placed significant amount of stress on him. Feeling trapped and stressed with the constant bombardment of phone calls from debt collections departments, our client contacted ChapterTwo for help.