video:

The ChapterTwo Proposal

Book in a time to call!

Please use the link below to choose a time to speak to a debt specialist:

https://calendly.com/chaptertwo/chaptertwodiscovery

Recent Case Studies

The Pregnant Pause

Debt – $90,000 in Credit Card & Personal Loans

Solution – Informal Debt Agreement

Overview

Our client started experiencing financial hardship when his wife fell pregnant with their first child and faced complications during the whole pregnancy and after the birth of their child. This warranted ongoing medical attention and she wasn’t able to work.

Our client wanting to do whatever it takes applied for credit cards and personal loans to get by and fell into the trap of using his credit facilities to cover medical costs and the shortfall in income due to his wife not working.

Soon his financial situation spiralled out of control and our client was unable not meet his debt repayment obligations. This significantly impacted our clients mental state, as being the sole provider for the family this placed significant amount of stress on him. Feeling trapped and stressed with the constant bombardment of phone calls from debt collections departments, our client contacted ChapterTwo for help.

How we helped:

The Pregnant Pause

Debt – $90,000 in Credit Card & Personal Loans

Solution – Informal Debt Agreement

Overview

Our client started experiencing financial hardship when his wife fell pregnant with their first child and faced complications during the whole pregnancy and after the birth of their child. This warranted ongoing medical attention and she wasn’t able to work.

Our client wanting to do whatever it takes applied for credit cards and personal loans to get by and fell into the trap of using his credit facilities to cover medical costs and the shortfall in income due to his wife not working.

Soon his financial situation spiralled out of control and our client was unable not meet his debt repayment obligations. This significantly impacted our clients mental state, as being the sole provider for the family this placed significant amount of stress on him. Feeling trapped and stressed with the constant bombardment of phone calls from debt collections departments, our client contacted ChapterTwo for help.

How we helped:

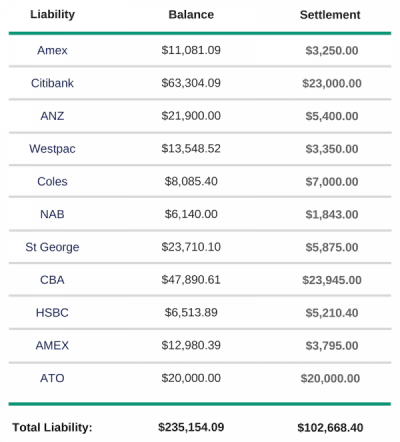

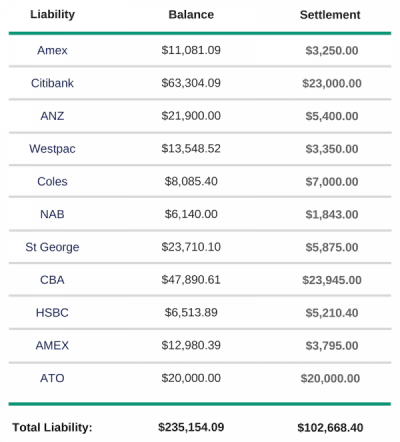

Refinance Your House With Defaults

Name – Chris & Claudia

Debt – $235,154.09

Solution – Debt Negotiation Refinance

Overview

Claudia and her partner Chris engaged us to assist them with their financial situation because their current debt levels were crippling them and they were both considering bankruptcy.

Luckily, we had a better solution whereby we could solve their debt troubles without filing for bankruptcy.The total monthly outgoings of all this high interest debt coupled with their mortgage repayments was $6,492. This wasn’t sustainable and a Debt Negotiation Refinance was the only way to financial freedom.

ChapterTwo didn’t need to enter their debts into hardship because up until that point they had been managing their repayments. We went straight to settlement and the figures are outlined below:

How we helped

Refinance Your House With Defaults

Name – Chris & Claudia

Debt – $235,154.09

Solution – Debt Negotiation Refinance

Overview

Claudia and her partner Chris engaged us to assist them with their financial situation because their current debt levels were crippling them and they were both considering bankruptcy.

Luckily, we had a better solution whereby we could solve their debt troubles without filing for bankruptcy.The total monthly outgoings of all this high interest debt coupled with their mortgage repayments was $6,492. This wasn’t sustainable and a Debt Negotiation Refinance was the only way to financial freedom.

ChapterTwo didn’t need to enter their debts into hardship because up until that point they had been managing their repayments. We went straight to settlement and the figures are outlined below: