Do you have clients with unsecured debts?

Do you have deals that aren’t servicing? Refer your ‘dead’ deals to ChapterTwo to see if we can bring them back to life..

Become a referral partner:

Do you have clients with unsecured debts?

Do you have deals that aren’t servicing? Refer your ‘dead’ deals to ChapterTwo to see if we can bring them back to life..

Become a referral partner:

video:

Do you want to help your clients?

Referrer Benefits

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.

Help Your Clients

Save Your Dead Deals

Earn Thousands in Commission

Reduce client's debts by up to 80%

We protect your client's credit rating

No Debt Agreements

Referrer Benefits

Help Your Clients

Save Your Dead Deals

Earn Thousands in Commission

Reduce client's debts by up to 80%

We protect your client's credit rating

No Debt Agreements

What is a Debt Negotiation Refinance?

A debt negotiation refinance by definition is when unsecured debts are settled at a reduced amount with an upfront payment through the refinance of our client’s property. For example:

What is a Debt Negotiation Refinance?

A debt negotiation refinance by definition is when unsecured debts are settled at a reduced amount with an upfront payment through the refinance of our client’s property. For example:

Example

Client has a $600,000 property

Mortgage is $450,000

Current debts: $80,000

If the broker was to try to refinance all of the unsecured debts the new LVR would be 88.33% which most lenders would not accept due to high levels of unsecured debts.

Solution

Chapter Two works with specialist lenders to obtain a pre-approval for the refinance on the basis the unsecured debts are settled, and the new loan amount is at 80% LVR.

Chapter Two will negotiate with the client’s creditors to achieve these settlement figures through our highly skilled negotiation team.

On $80,000 of debt we will need to settle at 37.5c in the dollar which leaves $30,000 to be rolled into the new loan

The new loan

Client has a $600,000 property | Mortgage is $480,000 | Current debts: $0

Example

Client has a $600,000 property

Mortgage is $450,000

Current debts: $80,000

If the broker was to try to refinance all of the unsecured debts the new LVR would be 88.33% which most lenders would not accept due to high levels of unsecured debts.

Solution

Chapter Two works with specialist lenders to obtain a pre-approval for the refinance on the basis the unsecured debts are settled, and the new loan amount is at 80% LVR.

Chapter Two will negotiate with the client’s creditors to achieve these settlement figures through our highly skilled negotiation team.

On $80,000 of debt we will need to settle at 37.5c in the dollar which leaves $30,000 to be rolled into the new loan

The new loan

Client has a $600,000 property | Mortgage is $480,000 | Current debts: $0

Recent Case Studies

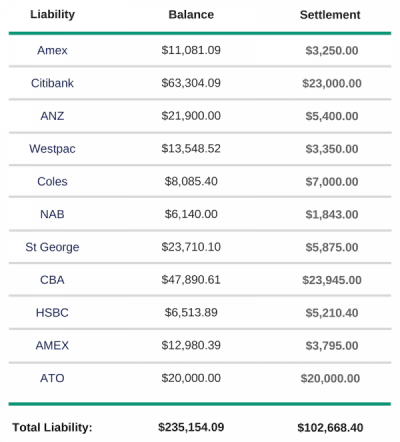

Case Study

Name – Chris & Claudia

Debt – $235,154.09

Solution – Debt Negotiation Refinance

Overview

Claudia and her partner Chris engaged us to assist them with their financial situation because their current debt levels were crippling them and they were both considering bankruptcy.

Luckily, we had a better solution whereby we could solve their debt troubles without filing for bankruptcy.The total monthly outgoings of all this high interest debt coupled with their mortgage repayments was $6,492. This wasn’t sustainable and a Debt Negotiation Refinance was the only way to financial freedom.

ChapterTwo didn’t need to enter their debts into hardship because up until that point they had been managing their repayments. We went straight to settlement and the figures are outlined below:

How we helped

Recent Case Studies

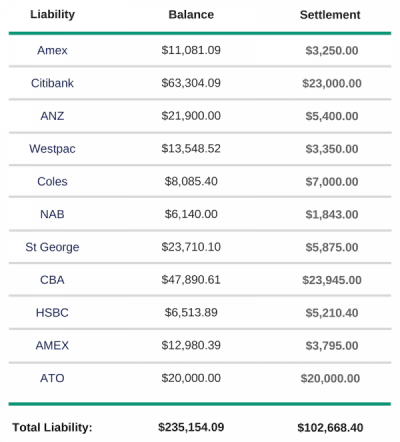

Case Study

Name – Chris & Claudia

Debt – $235,154.09

Solution – Debt Negotiation Refinance

Overview

Claudia and her partner Chris engaged us to assist them with their financial situation because their current debt levels were crippling them and they were both considering bankruptcy.

Luckily, we had a better solution whereby we could solve their debt troubles without filing for bankruptcy.The total monthly outgoings of all this high interest debt coupled with their mortgage repayments was $6,492. This wasn’t sustainable and a Debt Negotiation Refinance was the only way to financial freedom.

ChapterTwo didn’t need to enter their debts into hardship because up until that point they had been managing their repayments. We went straight to settlement and the figures are outlined below:

How we helped

The Negotiation Process

We listen and learn

The first step towards a debt-free outcome

Create room to breathe

We stop the calls and deal with the banks

We settle their debt

Finally, we follow your plan to help get your client’s out of debt

The Negotiation Process

We listen and learn

The first step towards a debt-free outcome

Create room to breathe

We stop the calls and deal with the banks

We settle their debt

Finally, we follow your plan to help get your client’s out of debt