Debt Negotiation Refinance

Got a mortgage? Consolidate your debts into a single payment. Free yourself from debt with ChapterTwo. Our experienced team can get you back on track today by negotiating a reduction on your debts using equity in your property.

Debt Negotiation Refinance

Got a mortgage? Consolidate your debts into a single payment. Free yourself from debt with ChapterTwo. Our experienced team can get you back on track today by negotiating a reduction on your debts using equity in your property.

What is a Debt Negotiation Refinance?

We settle your unsecured debts at a significantly reduced amount – by offering an upfront payment to your creditors using equity in your property.

Never heard of this process before? That is because there are no other companies that specialise in this process. Over the years of assisting our clients with debt solutions we noticed that a lot of our clients had equity in their property but not enough to consolidate all of the debts. That is when the debt negotiation refinance was born.

Utilising our skills in full & final settlements we established a mortgage division of ChapterTwo. We assess our client’s serviceability to refinance their current mortgage. We provide the most competitive rate and apply for the maximum amount our clients can afford. We use the equity available to offer a settlement on our client’s debts which does not impact their credit file and consolidates all of the debt into the mortgage.

What is a Debt Negotiation Refinance?

We settle your unsecured debts at a significantly reduced amount – by offering an upfront payment to your creditors using equity in your property.

Never heard of this process before? That is because there are no other companies that specialise in this process. Over the years of assisting our clients with debt solutions we noticed that a lot of our clients had equity in their property but not enough to consolidate all of the debts. That is when the debt negotiation refinance was born.

Utilising our skills in full & final settlements we established a mortgage division of ChapterTwo. We assess our client’s serviceability to refinance their current mortgage. We provide the most competitive rate and apply for the maximum amount our clients can afford. We use the equity available to offer a settlement on our client’s debts which does not impact their credit file and consolidates all of the debt into the mortgage.

Download our app & watch your balance decrease without interest compounding

This app is the first of its kind in Australia. See your debts in one place without having to login to numerous internet banking sites!

Just one regular payment!

View your live credit score

Stop the calls

We protect your credit rating

No Debt Agreements

Freeze interest & repayments

Reduce debts by up to 80%

Full Support

Download our app & watch your balance decrease without interest compounding

This app is the first of its kind in Australia. See your debts in one place without having to login to numerous internet banking sites!

Just one regular payment!

View your live credit score

Stop the calls

We protect your credit rating

No Debt Agreements

Freeze interest & repayments

Reduce debts by up to 80%

Full Support

The Process

How does a Debt Negotiation Refinance work?

Get in touch with ChapterTwo

Call ChapterTwo on 1300 344 433 or submit a contact form and we will call you at a time that best suits you. We will evaluate your situation so that we can make sure a Debt Negotiation Refinance is right for you.

We assess your situation

We assess your situation and find the most affordable and cheapest rate in the market for you

Refinance

We apply for pre-approval of a refinance on your mortgage.

We reduce your settlement amount

Once we have the pre-approval our debt settlement experts negotiate the reduced settlement amounts with your creditors.

Your debt is settled

Once the debts are successfully settled, we provide the settlement letters to the new mortgage lender to refinance and close out your debts at a reduction.

You are left with one easy payment

You make one payment towards your mortgage!

How does a Debt Negotiation Refinance work?

Get in touch with ChapterTwo

Call ChapterTwo on 1300 344 433 or submit a contact form and we will call you at a time that best suits you. We will evaluate your situation so that we can make sure a Debt Negotiation Refinance is right for you.

We assess your situation

We assess your situation and find the most affordable and cheapest rate in the market for you.

Refinance

We apply for pre-approval of a refinance on your mortgage.

We reduce your settlement amount

Once we have the pre-approval our debt settlement experts negotiate the reduced settlement amounts with your creditors.

Your debt is settled

Once the debts are successfully settled, we provide the settlement letters to the new mortgage lender to refinance and close out your debts at a reduction.

You are left with one easy payment

You make one payment towards your mortgage!

Recent Case Studies

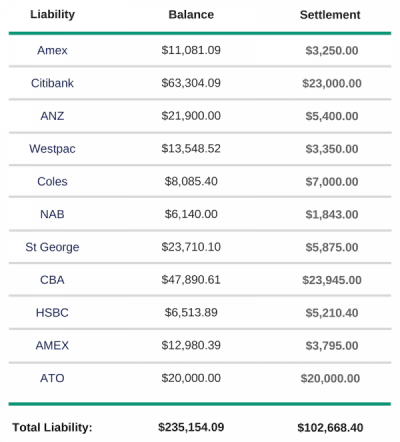

Case Study

Name – Chris & Claudia

Debt – $235,154.09

Solution – Debt Negotiation Refinance

Overview

Claudia and her partner Chris engaged us to assist them with their financial situation because their current debt levels were crippling them and they were both considering bankruptcy.

Luckily, we had a better solution whereby we could solve their debt troubles without filing for bankruptcy.The total monthly outgoings of all this high interest debt coupled with their mortgage repayments was $6,492. This wasn’t sustainable and a Debt Negotiation Refinance was the only way to financial freedom.

ChapterTwo didn’t need to enter their debts into hardship because up until that point they had been managing their repayments. We went straight to settlement and the figures are outlined below:

How we helped

Recent Case Studies

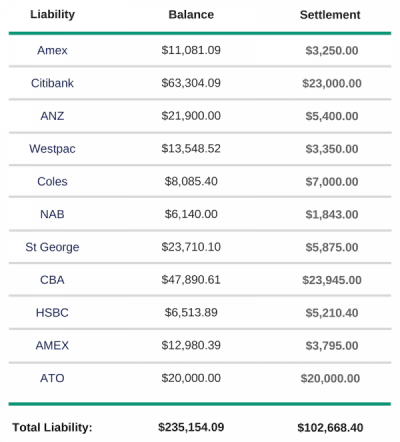

Case Study

Name – Chris & Claudia

Debt – $235,154.09

Solution – Debt Negotiation Refinance

Overview

Claudia and her partner Chris engaged us to assist them with their financial situation because their current debt levels were crippling them and they were both considering bankruptcy.

Luckily, we had a better solution whereby we could solve their debt troubles without filing for bankruptcy.The total monthly outgoings of all this high interest debt coupled with their mortgage repayments was $6,492. This wasn’t sustainable and a Debt Negotiation Refinance was the only way to financial freedom.

ChapterTwo didn’t need to enter their debts into hardship because up until that point they had been managing their repayments. We went straight to settlement and the figures are outlined below:

How we helped

Take control of your debt today

The journey to financial freedom is just 60-seconds away. Simply fill in the form below to get started.

Once completed we will be in touch with a plan to start reducing your debts.

Contact Us

Take control of your debt today

The journey to financial freedom is just 60-seconds away. Simply fill in the form below to get started. Once completed we will be in touch with a plan to start reducing your debts.